free cash flow yield private equity

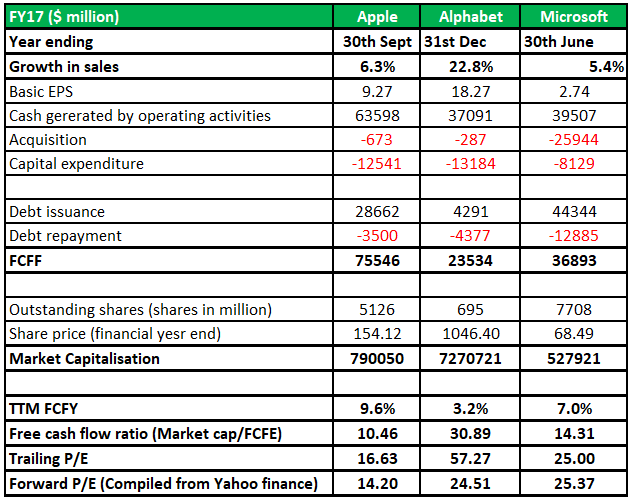

The model is detailed and covers all the relevant concepts used in private equity cash flow models. READING ASSIGNMENTS Reading 31 Free Cash Flow Valuation by Jerald E.

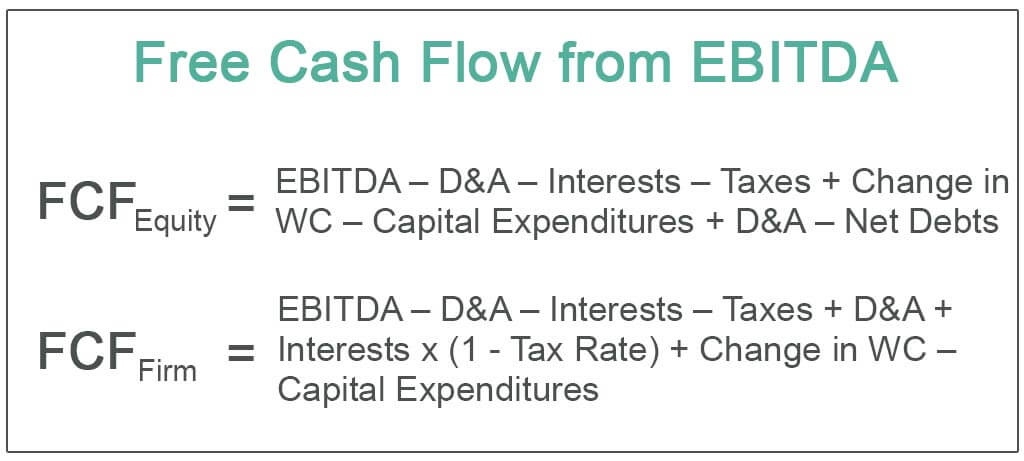

Unlevered Vs Levered Fcf Yield Formula Example Calculation

Why Private Equity.

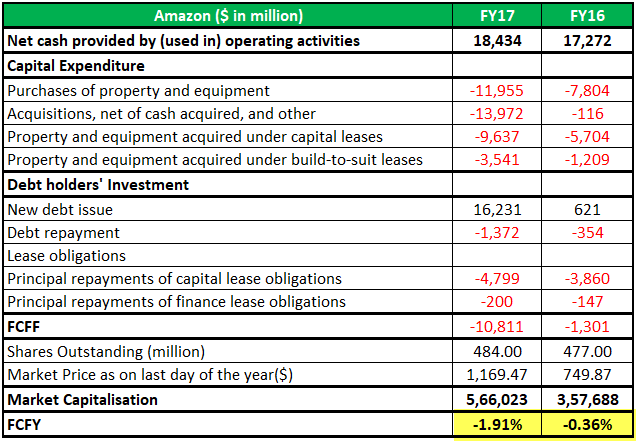

. By Prospect in IB-MA. The firms net debt and the value of other claims are then subtracted from EV to calculate the equity value. Heres the fun part.

The ratio is calculated by taking. The formula shown below is just a derivation of the formula above as the only difference is that both the numerator and denominator were divided by the total number of shares outstanding. Free Cash Flow to Equity FCFE.

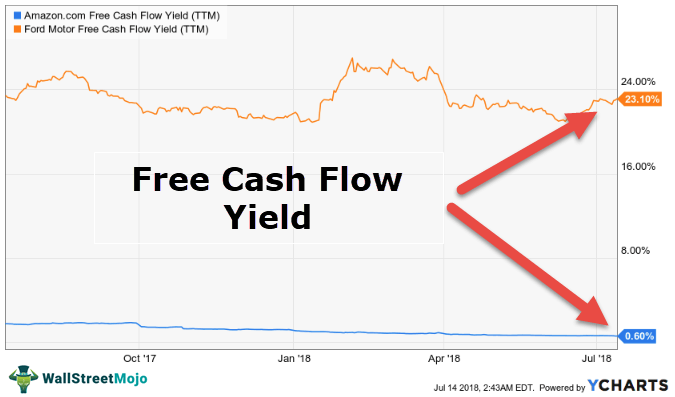

Suppose you bought a property and your net cash flow was 5000 and the cash invested in your property was 50000. Analysts like to use free cash flow either FCFF or FCFE as the return. Free cash flow yield is really just the companys free cash flow divided by its market value.

Allows you to monitor and compare real-time. Covering free cash flow yield unit economics modeling operating leverage and the ins and outs of the recruiting process. Free cash flow yield is computed as the ratio of free cash flow to the initial value of the asset.

Discounting free cash flows to firm FCFF at the weighted average cost of capital WACC yields the enterprise value. View past offers and learn more about our unique model. Free Cash Flow and CAPEX.

Going forward there is no way to be sure that free cash flow yield will continue to provide the best returns. Equity free cash-flow yield Equity free cash-flow is the cash generated each year for shareholders after certain non-discretionary expenses have been paid. Thats 2 the same as the bond.

Alternatively the levered FCF yield can be calculated as the free cash flow on a per-share basis divided by the current share price. 1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O. Free Cash Flow Help.

High transparency exclusive deals. Please note that in a discounted cash flow model we will be using the free cash flow to the firm and not the free cash flow to equity. 1 0 Y A F C F O S O W P S P L C A I where.

Using that example your Cash Yield is 10 500050000. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. In fact there have been market cycles where companies with high free cash flow yields have.

Ad Dont get lost in the info needed to screen a commercial Real Estate investment. Pinto PhD CFA Elaine Henry PhD CFA. The main approaches for valuing private company equity income market asset based conclude the session.

Bloomberg Terminal Shortcuts. This provides a more direct way. Cash flows are minimal or volatile or when difficulties exist in forecasting long-term terminal values follows.

What is Leveraged Finance. In the next approach the formula for FCFE starts with cash flow from operations CFO. The index-level yield is calculated as the weighted average using the fair value of each constituent.

If only the free cash flows to equity FCFE are discounted then the relevant discount rate should be the required return on equity. The Shareholders Equity Statement on the balance sheet details the change in the value of. The net property investment is usually the down payment which is the propertys cost minus the amount you borrowed.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. It ignores capital gains. In our model we have assumed this growth rate to be 3.

Our goal is to enable users inexperienced with the terminal to do a proper analysis. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital. Please let me know if you need specific modifications in the model or place a customized request.

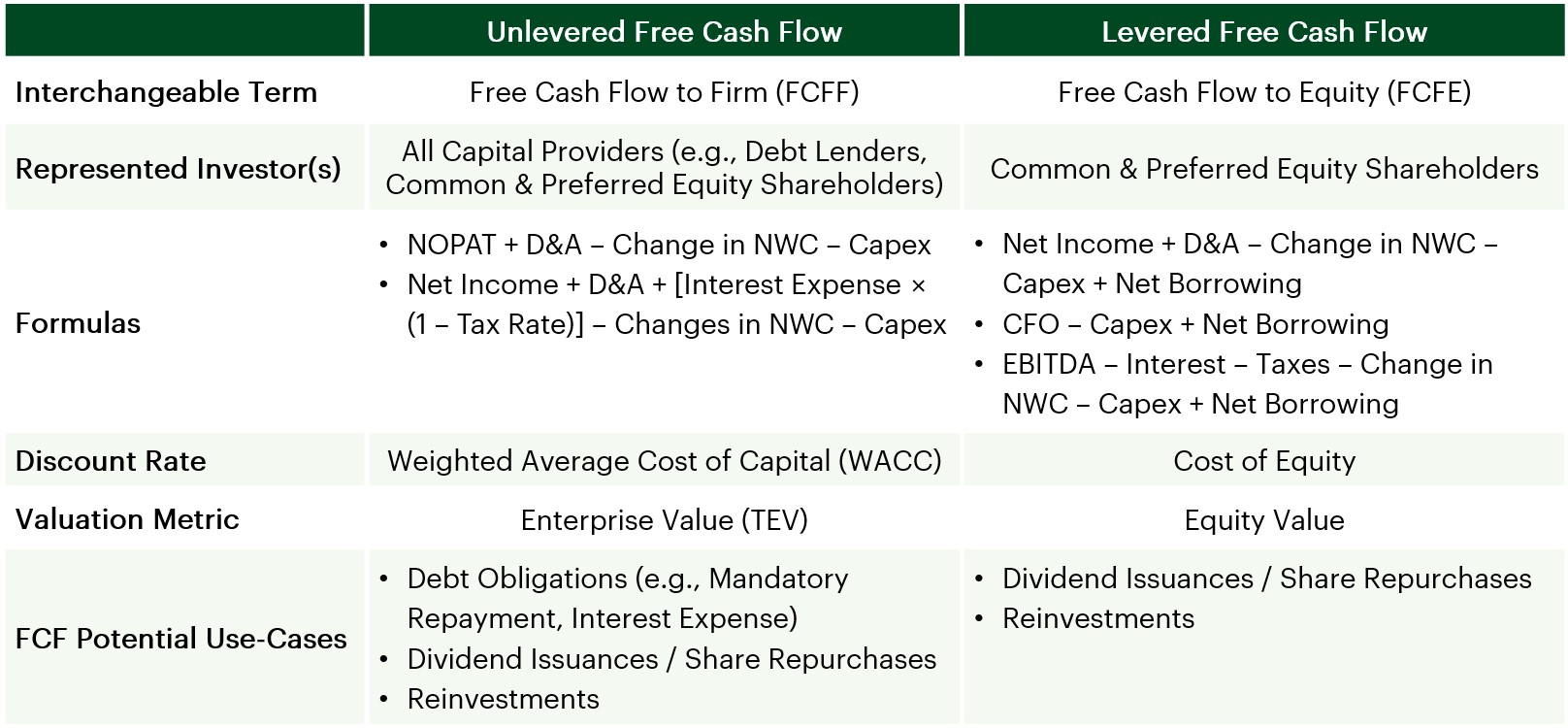

Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. We identify the most significant challenges we face and provide a useful bloomberg cheat sheet. Free cash flow to equity is the cash flow remaining after all obligations including any interest and debt repayments have been made.

The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity. FCFE CFO CapEx Net Borrowing. EBITDA vs Free Cash Flow.

By Analyst 2 in IB - Ind. The model can be used as a template by any private equity firm raising funds and looking at portfolio investments. Calculation of Free Cash Flow Yield FCFY Free Cash Flow Yield can be calculated from the equity shareholders Equity Shareholders Shareholders equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities.

Once you calculate the Terminal Value then find the present value of the Terminal Value. Be Prepared When Recruiting Kicks Off Private Equity Recruiting Course. Levered FCF Yield Free Cash Flow to Equity Equity Value.

If the company is not paying dividends. We illustrate our experience using the Bloomberg terminal in an equity-focused analysis. Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns.

Formula from Cash from Operations CFO FCFE. Free Cash Flow to Equity FCFE is the amount of cash generated by a company that can be potentially How to Calculate FCFE from EBITDA How to Calculate FCFE from EBITDA You can calculate FCFE from EBITDA by subtracting interest taxes change in net working capital and capital expenditures and then add.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Vs Levered Fcf Yield Formula Example Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation